I live in California and the cost of living can be discouraging at times. Housing prices are soaring, the expense of a college education is going up, and our kids have more expenditures too. I used to think buying diapers was a struggle. Turns out piano lessons and braces are our new big budget items. As a parent, I want to make sure that our kids have what they need to start their adult life. It’s hard to prioritize where to save and spend our money.

I remember thinking we would never own our own home. It felt like we were throwing away our money on rent, but much like times are now, it was hard to secure a mortgage, save 20% for a down payment, and find a home we could afford. While it did take a long time to save, we were glad we were serious about our goal early on in our marriage. It’s with great pride and joy that we are raising our children in a home we worked hard to own. I want my Annabelle to grow her own roses one day to sit on her kitchen table. We sought guidance from financial advisors and had some savings we had from investments our parents helped us make. This helped us buy our first home in 2009 and we want to set our own kids up to do the same when they grow up.

Part of being able to afford a mortgage and own your own property is having a job to support these dreams. Many people struggle to get good jobs because they don’t have the right kind of education. Going to a university costs a small fortune! I want to help our kids as much as we can with their education because I know this will give them an advantage in their life. The thought of them having overwhelming school bills makes me sad. To help your children when they get to this stage in life, you need to start thinking about the money you can save towards it now.

Part of being able to afford a mortgage and own your own property is having a job to support these dreams. Many people struggle to get good jobs because they don’t have the right kind of education. Going to a university costs a small fortune! I want to help our kids as much as we can with their education because I know this will give them an advantage in their life. The thought of them having overwhelming school bills makes me sad. To help your children when they get to this stage in life, you need to start thinking about the money you can save towards it now.

Time is a big factor in your saving success. This may sound extreme, but we started an education savings plan for our first child when I was pregnant. You set up the nursery before your baby arrives, why not think about a savings account too! There are many child savings accounts available. You have more time to save and earn more on what you’ve invested if you are working on it for years. That being said, our oldest turned 11 this week and we’ve been saving for his education for over a decade! Sadly, it still won’t be enough to fully pay for his education, but we are in a better position then we would be had we not started saving so early. Since you can’t jump in a time machine and go back and start saving, there’s no better time then the present.

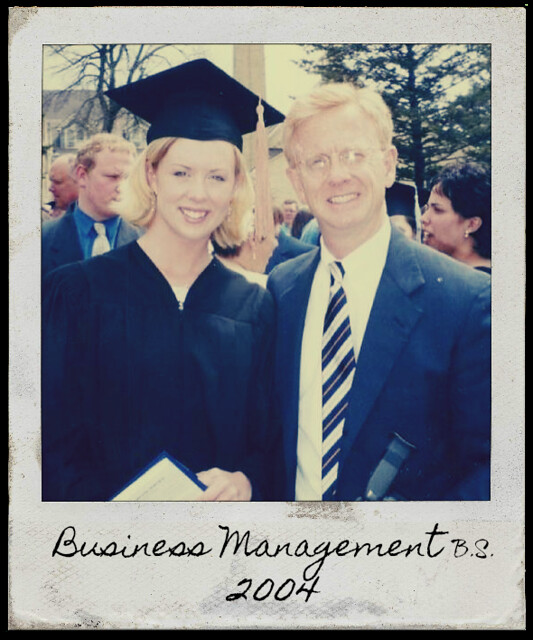

We hope to be a good example to our kids like our parents were to us when it came to financial planning. My parents funded my college expenses and I’m so grateful for that help. One day I hope to set our kids up for the same successes in life. They can repay us by taking us on a cruise! Just kidding of course! Or am I?

We hope to be a good example to our kids like our parents were to us when it came to financial planning. My parents funded my college expenses and I’m so grateful for that help. One day I hope to set our kids up for the same successes in life. They can repay us by taking us on a cruise! Just kidding of course! Or am I?

I’m so grateful that my parents helped me with my education expenses. I didn’t realize until after the fact what a generous gift that was and how nicely it set me up for a comfortable future. School debt can’t always be avoided, but I hope to do everything we can to save for our kid’s futures.